Retirement isn’t what it used to be. It’s typically longer and more active, doesn’t start at the same age for everyone, and could involve paid work. Not everyone’s retirement will look the same, and it doesn’t have to. Maybe you’ll transition to part-time before fully retiring, or maybe you’re looking forward to a second career doing something you love. 86% of Americans in their 50s say they’ll work part-time in retirement, and 66% of those in their 60s say they plan to do so.[1] However, working in retirement can have implications for Social Security benefits, taxes, and healthcare. So, if you’re planning to work longer or in retirement, know these four rules.

Your Social Security Benefit Can Be Taxed

If your combined income as an individual is between $25,000 and $34,000 or is between $32,000 and $44,000 as a married couple filing jointly, up to 50% of your benefit may be taxable. And if your combined income is over these amounts, up to 85% of your benefit may be taxable.[2] This is an important thing to understand about taxes in retirement, whether you are earning income or not.

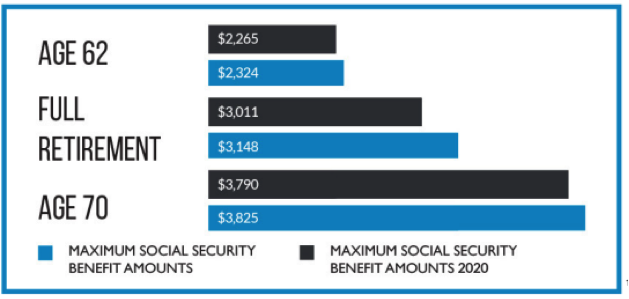

If you are earning income, know that Social Security beneficiaries under their full retirement age who earn more than $18,240 in 2020 will have $1 withheld for every $2 they earn above this limit. This earnings limit jumps to $48,600 for recipients in the year they reach their full retirement age when the penalty decreases to $1 withheld for every $3 earned above the limit. After someone reaches their full retirement age, there is no deduction taken based on earnings.[3]

You Can Continue to Contribute to an IRA

The rules have changed. The SECURE Act allows those earning income of any age to contribute to a traditional IRA.[4] Previously, workers 70 ½ and older could not contribute. If you’re earning income, you can also contribute to a Roth IRA. You can also convert part or all of a traditional 401(k) to a Roth IRA. In this case, you would pay tax on the funds converted and then be able to withdraw them tax-free later on. Note that you’ll still have to take Required Minimum Distributions from a traditional IRA starting at age 72, even if you are still making contributions.

At 65, You Can Opt for Medicare Coverage

If you are still able to be covered by your employer’s health insurance plan, you have options when you turn 65. You can either keep your insurance and delay Medicare Part B enrollment, decline employer coverage and only rely on Medicare, or have employer coverage and Medicare Part A at the same time.[5] Keep in mind that at age 65 you may automatically be enrolled in Medicare Parts A and B if you are receiving Social Security benefits, so decide on a plan of action before your 65th birthday.

Whatever your plans are for retirement, make sure you have a solid financial plan to go along with them. A retirement income plan and tax minimization strategy are important, and the right ones will depend on your unique financial situation. There are ways we can help you this tax season and beyond. You can meet us during a complimentary financial review and learn how we could help you.

[1] https://s2.q4cdn.com/437609071/files/doc_news/research/2019/unretirement-survey.pdf

[2] https://www.ssa.gov/benefits/retirement/planner/taxes.html

[3] https://www.ssa.gov/benefits/retirement/planner/whileworking.html

[4] https://www.congress.gov/bill/116th-congress/house-bill/1994/

[5] https://www.aarp.org/health/medicare-qa-tool/do-i-enroll-in-medicare-age-65-even-if-still-working/